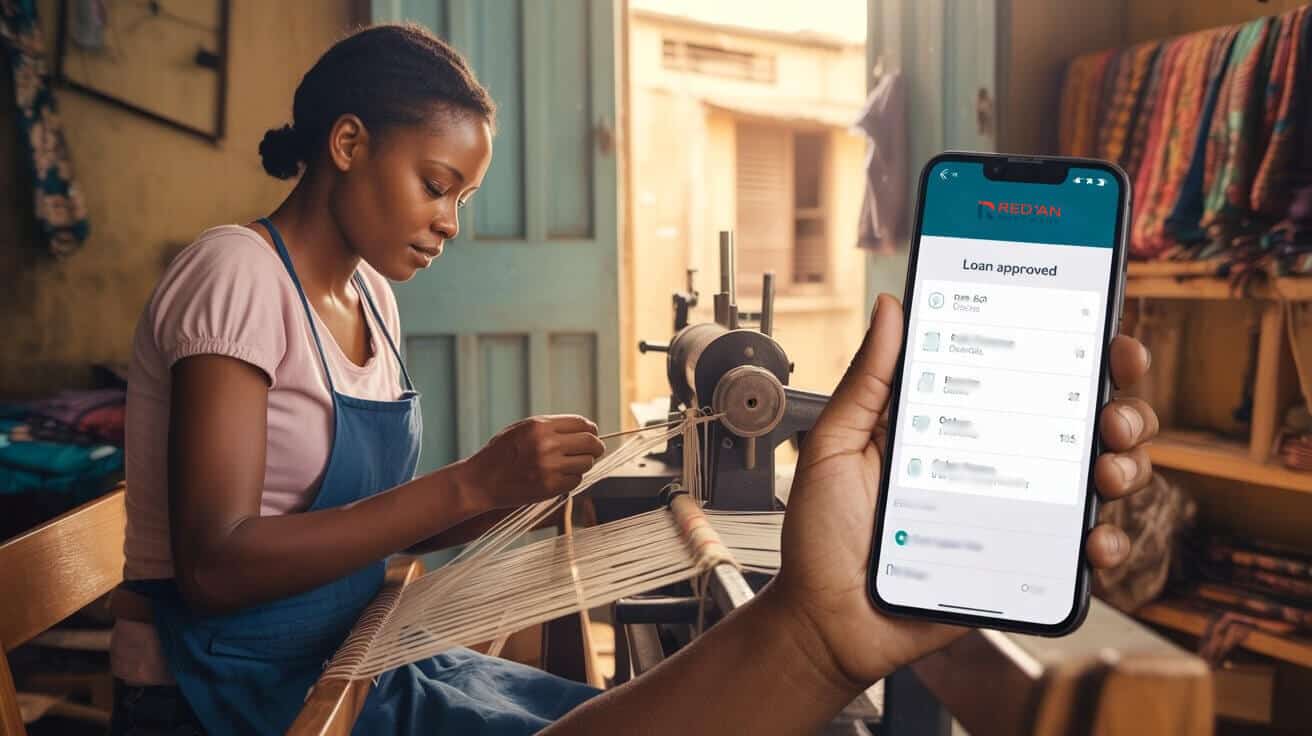

Transforming Lending for African Communities Through Digital Loan Platforms

Africa, a continent full of young, vibrant people and entrepreneurial drive, has long struggled with major obstacles to formal financial services. This challenge is profound, with over 50% of deserving populations in Africa remaining unbanked, representing more than 350 million individuals (EJBMR). Globally, 1.7 billion people lack basic financial services, highlighting immense untapped economic […]

Transforming Lending for African Communities Through Digital Loan Platforms Read More »